Blogs

Setting W-9 must be used whenever payees have to certify your amount furnished is right, otherwise when payees need to certify which they’re maybe not at the mercy of backup withholding or is actually excused from duplicate withholding. The fresh Guidelines on the Requester from Function W-9 were a listing of sort of payees that excused out of copy withholding. 1281, Copy Withholding to possess Forgotten and you may Completely wrong Name/TIN(s). You could potentially afford the amount owed revealed in your work taxation get back by borrowing from the bank or debit card.

Which extra lets the fresh members to make $400 once they put $dos,000 into their profile to make 20 debit cards requests. Your own refund is always to just be transferred in to a great Us bank or All of us bank associated accounts which can be on the individual term, your lady’s name or each other if this’s a shared account. Only about around three digital refunds is going to be deposited to the a single economic membership otherwise pre-repaid debit card. Taxpayers just who meet or exceed the newest restriction are certain to get an enthusiastic Internal revenue service find and a newspaper reimburse.

You need to slow down the limit on the contributions, prior to taking into account any additional contributions, by the number triggered each other partners’ Archer MSAs. Up coming prevention, the fresh share limit is separated just as between your partners unless you agree with a different section. You should slow down the amount which can be discussed (and any additional share) to the HSA by the amount of any contribution made to your Archer MSA (and employer contributions) on the 12 months. An alternative signal pertains to married couples, talked about second, if per companion has members of the family publicity below an HDHP. While you are a qualified person who is actually many years 55 otherwise elderly at the conclusion of your taxation seasons, the share limit try improved by $1,one hundred thousand. For example, when you have mind-only visibility, you can lead around $5,150 (the new contribution restriction for thinking-simply publicity ($4,150) and the more share of $1,000).

Costs Excused Out of FUTA Income tax

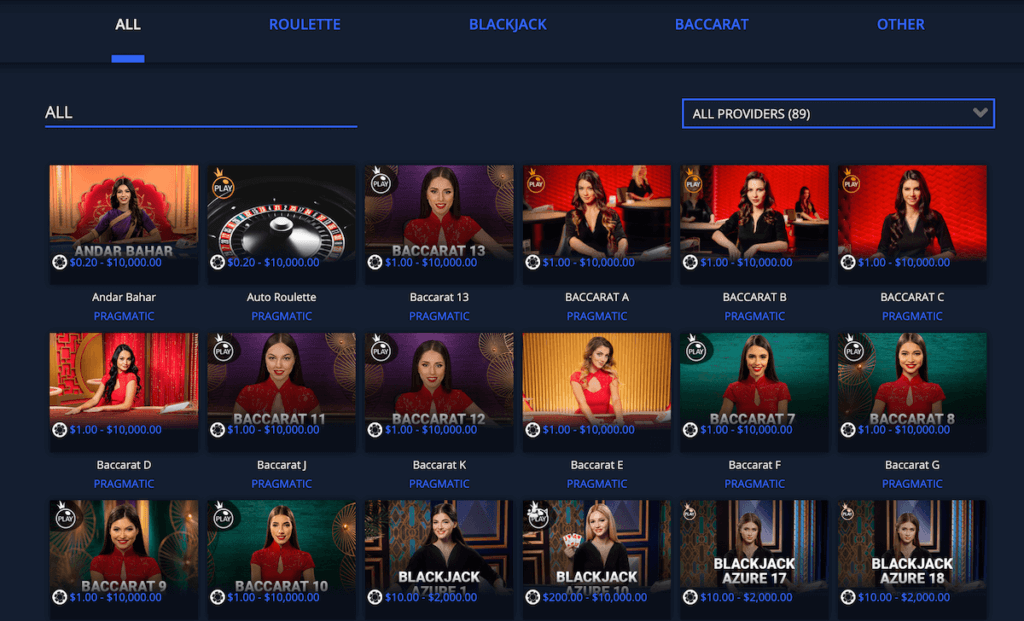

To have Computer game accounts away from 1 year otherwise shorter, the fresh penalty commission is 90 days of interest. Very no-deposit bonuses are provided therefore gambling enterprises is also stand out from their competitors within the fiercely competitive segments. Such as, there are many Michigan online casinos fighting for the very same customers, so a no-deposit bonus are a robust product sales tool. 100 percent free spins bonuses prize you having spins to the a specific position otherwise a variety of pokies.

If the All Nonexempt FUTA Wages Your Paid Had been Omitted Away from State Unemployment Tax . . .

The brand new election and you may determination of best site your credit amount and that is used contrary to the employer’s payroll fees are built to the Function 6765, Credit to possess Expanding Research Things. Any leftover credit, just after decreasing the company display away from personal shelter income tax and the boss show of Medicare tax, will be transmitted forward to another one-fourth. Mode 8974 can be used to search for the amount of the credit which can be used in today’s quarter. The quantity away from Setting 8974, range a dozen, otherwise, if appropriate, range 17, is stated on the Function 941, Setting 943, or Setting 944. To learn more about the payroll tax borrowing, find Irs.gov/ResearchPayrollTC. Separate accounting may be needed if not spend more than withheld staff public security, Medicare, otherwise taxes; deposit expected taxes; create needed money; otherwise file tax returns.

Yearly Get back away from Withheld Federal Taxation

In case your number claimed online 5 is actually besides zero, use this range to add a conclusion on the difference. In the event the additional area is required, attach a layer in order to create 1042 explaining the real difference listed on range 5. The total amount on the internet 5 ought to be the complete advertised to the range 4 (total number of You.S. source FDAP earnings said to the all of the Forms 1042‐S) quicker the complete advertised on the internet 3 (full You.S. origin FDAP money reportable less than section 4). The full of one’s numbers advertised on the traces 63b(1) and you may 63b(2) will be equal the sum of the all of the numbers advertised inside the box 8 of all of the Versions 1042-S taken to recipients. This is actually the taxation accountability to the months (March 8 because of 15) when they generated a delivery. This is basically the tax accountability to your months (April step one due to 7) where they provided the brand new Dates K-step one (Setting 1065) on the partners.

To make $three hundred, you need to deposit no less than $2,one hundred thousand inside the new money in this 1 month and keep so it balance for around 60 days. To make $500, you should deposit and keep maintaining no less than $10,one hundred thousand inside the new currency. Both for also offers, you’ll also must complete five qualifying deals — debit cards requests, ACH transfers, wiring, Chase QuickAccept and QuickDepositSM transactions, and you can costs pay — in this ninety days out of render registration.

Range 9 doesn’t connect with FUTA earnings on what your paid zero county unemployment income tax because the state tasked you a good taxation rate out of 0%. Enter online 5 the entire of your money over the FUTA wage feet you repaid to each and every worker through the 2024 once deducting one costs excused of FUTA tax revealed on the web cuatro. For individuals who go into a price online cuatro, read the suitable box otherwise packages to the contours 4a thanks to 4e to display the types of money exempt of FUTA taxation. You merely statement a cost while the exempt of FUTA taxation to your line cuatro for individuals who integrated the newest payment on line step three.

Monthly fee

The brand new FDIC—quick for the Federal Deposit Insurance policies Corporation—try a different service of your own Us bodies. The fresh FDIC handles depositors away from insured financial institutions found in the Joined States against the loss of its places, in the event the an insured bank goes wrong. Their Insured Deposits is an extensive dysfunction of FDIC put insurance rates coverage for the most popular account control groups. For many who exit $10,100 inside the a savings account you to definitely will pay cuatro % APY to have a year, you can earn as much as $400 in the interest. Inside the a traditional savings account during the 0.01 % APY, it is possible to earn to one-dollar. So it change in the amount of money speed will lead to down APYs in your savings account.

- Dividends to the Langley Government Borrowing from the bank Connection Certification away from Dumps try combined and you may paid to your account monthly.

- The fresh Delaware Department of Tax has created a keen on the web webpage you can access to test the brand new reputation of the condition refund.

- After you have used up each of 100 percent free spins, you could withdraw him or her immediately after appointment the newest wagering criteria.

The fresh Internal revenue service reminds taxpayers who’ve not yet filed its 2021 tax returns they can be eligible for a reimbursement if the they file and you may allege the newest Data recovery Rebate Credit by the April 15, 2025, due date. Don’t have a check offered to to locate their routing and account matter? A navigation matter identifies the spot of the financial’s part the place you opened your bank account and most banks listing its routing number on the websites. Your bank account number usually can be found by the signing into your on line bank-account otherwise because of the getting in touch with your bank part. Visit Shell out.gov’s assistance page to find versions and then make costs or rating contact details to dicuss to spend.gov myself. You are permitted claim a great 2021 Recovery Rebate Credit on the 2021 federal taxation go back.

Get in touch with an associate your people today to discover more about just how the functions is also increase bucks administration to suit your needs. Staying away from direct put doesn’t prohibit you from all promotions where you can make bonus money by the starting a new membership. Multiple associations give offers in order to consumers instead which demands, along with HSBC, TD Financial, Chase, and Alliant. Occasionally, sure — particularly if the consumer is actually better-structured, understands the brand new words, which can be comfy controlling multiple membership.

Inside 2024, USP, an excellent You.S. partnership, have foreign people which can be people as well as for which it provides received appropriate records to ascertain their overseas position. The new withholding tax less than section 1441 regarding the distributive shares of your international people is actually $120. For the 2024 Mode 1042, USP did not get into people count because the income tax accountability for the contours step one because of 60 because it didn’t spread any number. A U.S. department of a good PFFI that is required to help you declaration quantity below chapter 4 must file another Function 1042. The level of taxation you are required to keep back find the brand new frequency of one’s places.

The amount of money and extra taxation is computed on the Function 8889, Part III. Get into levels of You.S. resource FDAP earnings not essential getting withheld abreast of lower than part 4 to your traces 2a thanks to 2d with respect to the exclusion to help you withholding you to placed on per percentage reportable on the Setting 1042-S. The quantity online 2e is to equivalent the sum of the lines 2a due to 2d. Failure to do this can lead to the new denial of your refund otherwise credit becoming said.