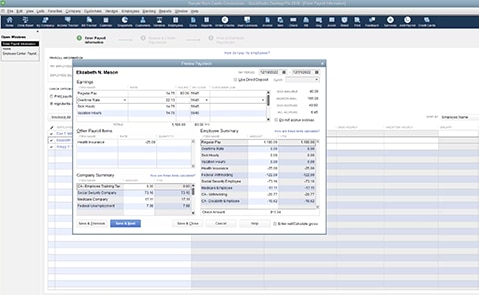

Calculating paychecks, printing checks, and submitting direct deposit funds are all made simple with the help of Enhanced Payroll. Dancing Numbers helps small companies, entrepreneurs, and CPAs to do good transferring of data to and from QuickBooks Desktop. Make The Most Of import, export, and delete companies of Dancing Numbers software. Let employees view digital pay stubs, W-2s, PTO balances and withholding allowances anytime, utilizing QuickBooks Workforce. Improve administrator productiveness by easily figuring out incomplete employee profiles.

Examined Solutions For Every Trade

When selecting payroll software program that actually addresses the wants and pain points of accountants, it is important to discover a software that does the fundamentals properly and then some. Integrations include direct knowledge trade with HMRC and pension providers such as NEST, The People’s Pension, Aviva, and Good Pension. It also integrates with accounting platforms like Xero, QuickBooks, and Sage for automatic journal posting, decreasing manual reconciliation and knowledge entry. In this guide, you’ll find options that match a range of workflows—whether you’re managing payroll for a few staff or a complete shopper portfolio. Stay in control by reviewing and approving payroll before you issue paychecks. Enhanced Payroll gives you insightful stories that assist observe employee time and expenses effortlessly.

Payroll and time monitoring knowledge join to extend efficiency, reduce tasks, and minimize payroll prices with Payroll Premium & Elite. We hope the above article might be very useful in tax funds and the submitting providers but in case you discover any problem then you can name us. Our skilled team will allow you to in resolving your downside and in tax payments and submitting additionally.

They have the necessary resources to access your account and information you thru reactivating the deleted EIN. Consider switching to QBD Enterprise Gold and buying a brand new license through a partner for perpetual reductions. Your whole cost must be lower than QB Desktop Pro Plus + QB Desktop Payroll. Let me provide you with an overview of our QuickBooks Desktop (QBDT) Payroll product so you can choose and buy the service that fits your business wants.

Whether it is quarterly stories or year-end summaries, everything’s in there. As Soon As you’ve got obtained every little thing set up, the Payroll Dashboard is your new greatest friend. Designed with busy accountants in mind, the dashboard offers a transparent overview of upcoming payroll duties and deadlines. Pretax deductions are subtracted from employees’ pay earlier than income taxes are calculated. These deductions assist reduce the amount automatically withheld to cowl the employee’s annual state and federal earnings tax bill. Sq Invoices promises to get your clients’ invoices paid fast by letting them see all features of the company’s cash circulate at a glance.

- Prioritize multi-client management, direct integrations with accounting software program, automated tax filings, audit trails, and robust reporting.

- In relation to the software, wants Intuit’s QuickBooks has a desktop model for the accounting and payroll options known as QuickBooks Desktop Payroll.

- Its intuitive interface and real-time monetary insights help business house owners keep management over their funds.

New Product Updates From Xero

The mistaken alternative can lead to compliance dangers, wasted time, and expensive errors that damage shopper trust. Enhanced Payroll provides a excessive stage of customization for payroll stories. You can tailor reports based on specific needs—whether it is month-to-month summaries, quarterly analyses, or annual overviews—to present precisely the insights you need. Absolutely, Enhanced Payroll is ideal for accountants managing a quantity of clients. You can keep each client’s payroll data separated and arranged, allowing for fast and seamless transitions between accounts as you work. For many accounting companies, their finest wager is to affix the QuickBooks ProAdvisor program that helps solo practitioners, small accounting practices and large accountant firms.

If your corporation requires tax calculation and/or submitting in more than one state, every additional state is $12/month for Core and Premium. The discounts don’t apply to additional employees and state tax submitting fees. When considering a payroll software program plan, it is important to evaluate the specific needs of your accounting practice and the extent of support and options you require. The proper stability between cost and functionality will ensure that you can present environment friendly and compliant payroll services to your purchasers.

Additional Sources

The software program is designed to handle various employment models, together with payroll, Employer of Document (EOR), and contractor management. The software program helps both single-company and multi-company payroll management, making it highly scalable for bureaus and rising businesses. Gusto simplifies payroll, benefits, and HR for accountants within a contemporary, automated platform. It’s recognized for delivering a contemporary payroll expertise through its revolutionary features and user-friendly design. This comparability chart summarizes pricing particulars for my top payroll software program selections for accountants that can help you discover one of the best software in your price range and business needs. With so many platforms providing overlapping options, from small-business necessities to enterprise-grade tools, choosing the proper answer can feel overwhelming.

Dealing With clients’ payroll is a core task of many accounting professionals, so that they stand to benefit most from payroll software’s capacity to automate tax calculations, direct deposits and other frequent payroll duties. As payroll processing hyperlinks more closely with other enterprise features, payroll software’s ability to integrate seamlessly with budgeting, expense administration and strategic planning instruments turns into a key consideration. The systems must additionally join securely and reliably with company and employee bank accounts. Options include automated payroll processing that ensures accuracy and compliance with tax legal guidelines.

Leveraging these tools can present a aggressive edge, enhance effectivity and accuracy, and assist compliance and knowledge security, all of that are important elements of profitable business operations. Integrations embody QuickBooks Desktop, QuickBooks Online, Patriot’s Accounting software, and different instruments for time and attendance, HR, and 401(k) management. Cover the basics—easily pay your team and have your payroll taxes done for you. Signal up for QuickBooks On-line Accountant to get QuickBooks Payroll Elite free on your firm and discounted payroll plans on your clients. With tax penalty safety, we’ll resolve filing errors and pay penalties up to https://www.intuit-payroll.org/ $25,000.